PROTON PAYDAY LOAN

GET FLEXIBLE FINANCIAL SOLUTION WITH IMMEDIATE LENDING AND EASY REPAYMENT OPTION FOR YOUR EVERYDAY FINANCIAL NEED.

Did You Hear?

“The struggle for financial freedom is very unfair. Just look at the rewards.”

– Manoj Arora

( Indian author, speaker, and mentor. )

If you’re ever in a pinch and need money immediately but don’t qualify for a personal loan, you might think about taking out a payday loan. A payday loan is a short-term, small loan that you repay once you receive your next paycheck, typically two to four weeks after you take out the loan. Payday loans tend to have small loan limits, usually up to $2000, and don’t require a credit check or guarantor.

If you’re in need of emergency cash, then payday loan can help you buy groceries, cover a car repair, pay for a doctor’s visit, or deal with any other everyday financial needs that pop up.

Payday loans are designed to provide consumers with emergency liquidity.

These loans are also known as cash advance loans, payroll loans, salary loans, or small-dollar loans.

A payday loan doesn’t have to be from a payday lender in a part of town you don’t visit often. Instead, you can get approved for a cash loan from Proton Loans. Instead of driving around town, you can submit an application form online at home and based on the information you provide, the money can be deposited directly into your bank account in as little as 24 hours on approved loans.

Some common features of a payday loan:

The loans are for small amounts, and many states set a limit on payday loan size. $500 is a common loan limit although limits range above and below this amount.

A payday loan is usually repaid in a single payment on the borrower’s next payday, or when income is received from another source such as a pension or Social Security. The due date is typically two to four weeks from the date the loan was made. The specific due date is set in the payday loan agreement.

To repay the loan, you generally write a post-dated check for the full balance, including fees, or you provide the lender with authorization to electronically debit the funds from your bank, credit union, or prepaid card account. If you don’t repay the loan on or before the due date, the lender can cash the check or electronically withdraw money from your account.

Your ability to repay the loan while meeting your other financial obligations is generally not considered by a payday lender.

The loan proceeds may be provided to you by cash or check, electronically deposited into your account, or loaded on a prepaid debit card.

Other loan features can vary. For example, payday loans are often structured to be paid off in one lump-sum payment. Some state laws permit lenders to “rollover” or “renew” a loan when it becomes due so that the consumer pays only the fees due and the lender extends the due date of the loan. In some cases, payday loans may be structured so that they are repayable in installments over a longer period of time.

THERE WILL BE NO WALL BETWEEN

YOU AND US

AS PROTON LOANS IS A

DIRECT LENDER

**** HENCE NO GLITCHES ****

Your application is rapidly handled and assisted with money sent directly into your account within 24 hours or the SAME DAY for FREE on loans approved

HERE’S HOW IT WORKS

Getting a loan through Proton Loans is a simple

*** 3 STEP PROCESS ***

APPLY ONLINE:

exploring your rate options won’t affect your credit score and if you qualify our simple application takes just a few minutes.

GET A FAST DECISION:

You like to move fast. We do, too.That’s why we offer decisions within minutes whenever possible.

RECEIVE YOUR FUNDS:

If approved, we’ll deposit money directly into your account within 24 hours or the SAME DAY for FREE.

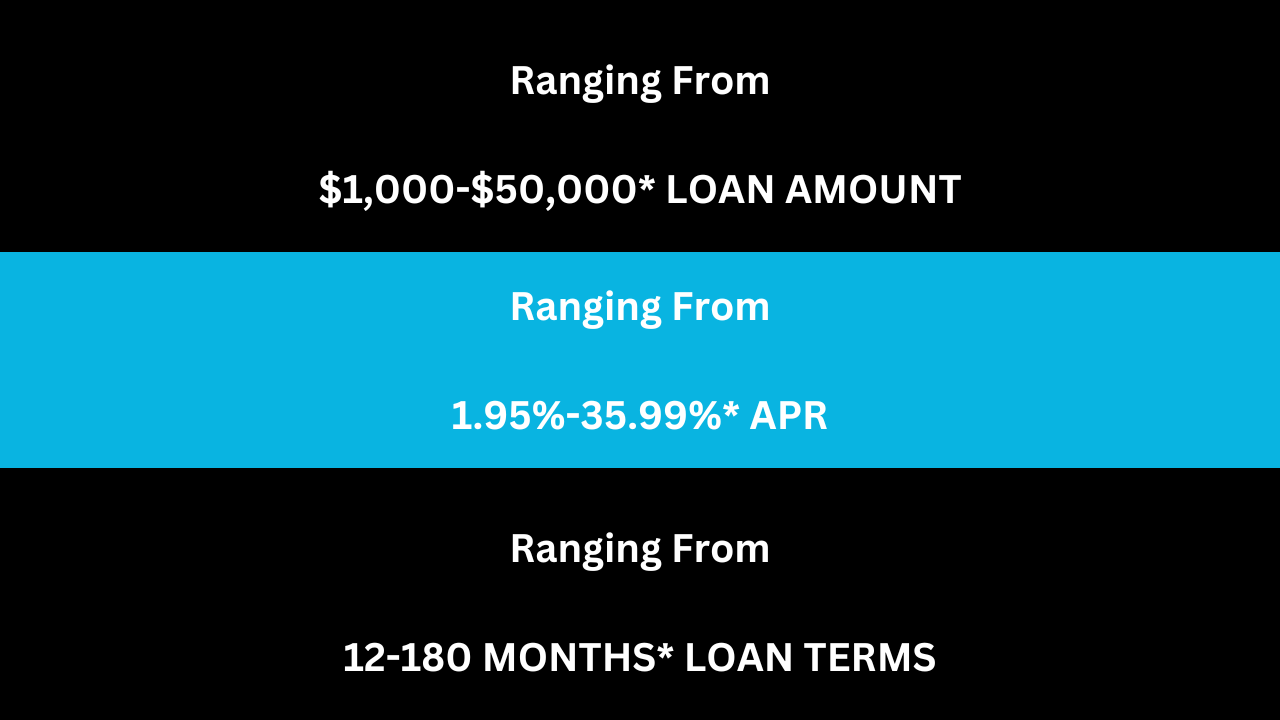

WE OFFER A RANGE OF LOAN OPTIONS

You have choices,

We’ll make sure you understand them.