PROTON MEDICAL LOAN

MAKE HEALTH EXPENSES MANAGEABLE WITH A MEDICAL LOAN.

Did You Hear?

"He who has health, has hope; and he who has hope, has everything."

-- Thomas Carlyle

( British essayist, historian, and philosopher. )

Health is priceless and illness can be very expensive. For a significant number of Americans, the cost of a medical emergency can put family finances in intensive care even after the body has recovered. PROTON LOAN'S MEDICAL LOAN can be a way to make these situations manageable.

PROTON LOAN'S MEDICAL LOAN covers health care costs. It can be used to finance emergency or planned medical procedures, consolidate existing medical debt, or pay for high deductibles and out-of-network charges. When it comes to emergency expenses, nothing hits quite as hard—or quite as fast—as medical bills. Even if you’ve had some time to prepare, the sticker shock from certain procedures and services can be staggering. Illness and injury play no favorites — rich or poor, good credit or bad, folks need medical care when they get sick or hurt. Unfortunately, medical bills are often devastating, especially if you have minimal insurance, a bad credit rating, or both. If you need help to cover medical bills, taking out PROTON LOAN'S MEDICAL LOAN might be a good option To cover the costs of both necessary and elective medical treatment, you might be considering taking out a medical loan. Perhaps you need to pay for a catastrophic emergency surgery that you didn’t anticipate, you are interested in scheduling cosmetic surgery, or you need help affording medical equipment. If you have outstanding medical debt, a PROTON LOAN'S MEDICAL LOAN with a low rate can help consolidate debt into one monthly payment for the loan term, which can help you pay it off faster. Most medical costs are unplanned expenses. Even planned procedures can put your budget under pressure. However, both preventive care and emergency treatment are crucial, PROTON LOAN'S MEDICAL LOAN could help cover the care you need.

THERE WILL BE NO WALL BETWEEN

YOU AND US

AS PROTON LOANS IS A

DIRECT LENDER

**** HENCE NO GLITCHES ****

Your application is rapidly handled and assisted with money sent directly into your account within 24 hours or the SAME DAY for FREE on loans approved

HERE’S HOW IT WORKS

Getting a loan through Proton Loans is a simple

*** 3 STEP PROCESS ***

APPLY ONLINE:

exploring your rate options won’t affect your credit score and if you qualify our simple application takes just a few minutes.

GET A FAST DECISION:

You like to move fast. We do, too.That’s why we offer decisions within minutes whenever possible.

RECEIVE YOUR FUNDS:

If approved, we’ll deposit money directly into your account within 24 hours or the SAME DAY for FREE.

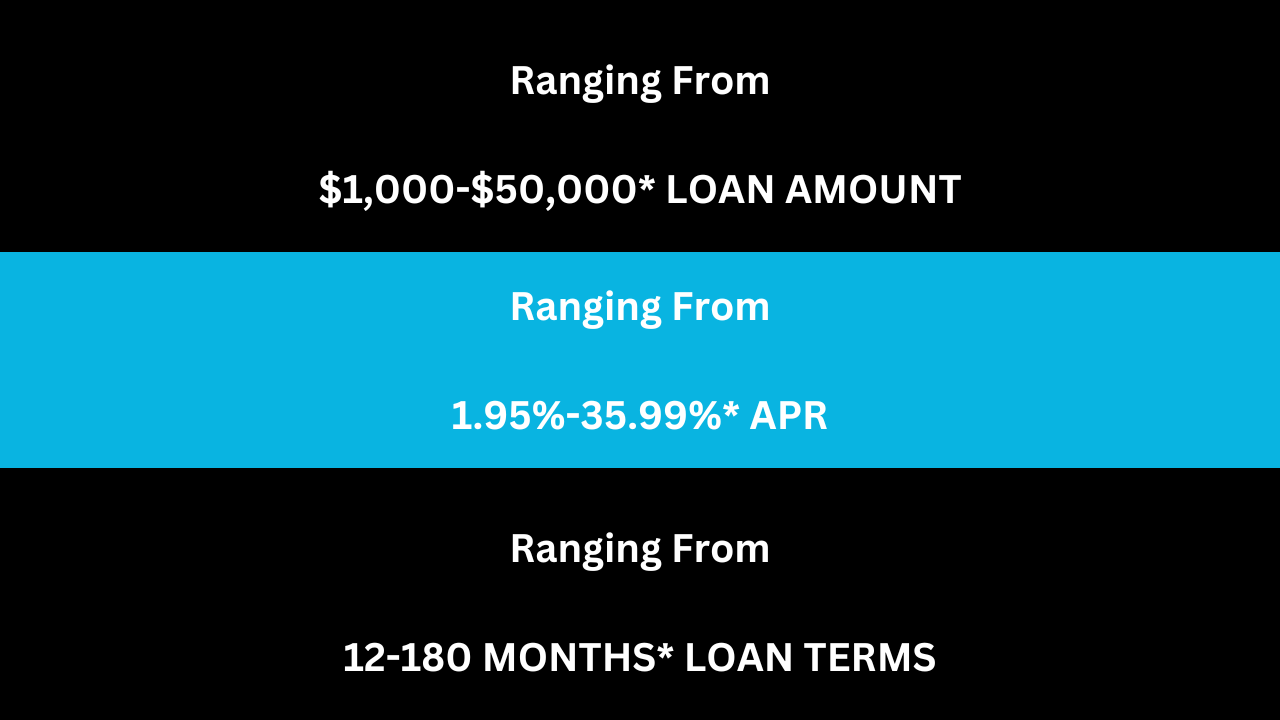

WE OFFER A RANGE OF LOAN OPTIONS

You have choices,

We’ll make sure you understand them.