PROTON DEBT CONSOLIDATION LOAN

Let’s do more than manage today’s debt; let’s make debt work for us instead of us always working for it. That means taking control of our personal finances and clean up your debt clutter with PROTON LOAN'S DEBT CONSOLIDATION LOAN.

Did You Hear?

“Take control of your finances, and you’ll witness how financial problems turn into opportunities for growth”

-Kiara Taylor

( Financial analyst and expert, equity research analyst, emerging markets strategist, and risk management specialist. )

-Kiara Taylor

( Financial analyst and expert, equity research analyst, emerging markets strategist, and risk management specialist. )

Paying off higher-rate debt is critical for financial health. The most important thing is to pick a method for paying off debt and stick with it. Your dedication can give you peace of mind, open up new financial opportunities, and put you on a path toward a more rewarding future.

If you have multiple sources of debt, like several credit cards or medical bills, managing all the monthly payments can be a lot of work.

Consolidating debt can help you combine multiple debt payments into one. This can make it easier to stay on top of your debt when you have fewer due dates, interest rates and payments to keep track of.

Did You Hear?

“I often say that paying off your debt is like dieting. There are no miracle cures; it takes discipline and hard work.”

Lisa Madigan

(American Lawyer and Politician)

Lisa Madigan

(American Lawyer and Politician)

If you have mounting debt, you're likely not alone.

If you're feeling overwhelmed by debt, now is a good time to take steps to pay it down quickly. See how much you could potentially save by consolidating your debt now!

Let's take a closer look at debt consolidation, how it works and how it can help you save money.

Debt consolidation refers to a loan allows you to combine multiple higher-rate balances into a single loan with one set regular monthly payment. It is one of several tools you might consider to gain control of your debt, from bills to credit cards with more favorable payoff terms, such as a lower interest rate, lower monthly payments, or both. You can potentially save thousands over the life of the loan.

designed to help people who are struggling with multiple high-interest loans.

Debt consolidation can help you feel in control and get excited about your path to a brighter financial future.

Dealing with debt doesn’t have to be complicated. If you want to pay down your loan balances and reduce the stress of multiple bills, PROTON LOAN'S DEBT CONSOLIDATION LOAN could be the answer. Consolidate your debt and get more peace of mind by turning multiple bills into a single monthly payment.

PROTON LOAN'S DEBT CONSOLIDATION LOAN the best debt consolidation loans are designed to free up your money for other expenses and help you breathe a little easier. At OneMain, we understand each customer is unique. There’s no “one size fits all.”

We’ll work with you one-on-one to understand your needs and help you decide and find a debt consolidation loan that fits your budget with best debt refinancing deal that allow you to pay off various unsecured debts by combining them into one loan with a fixed monthly payment with a ability to obtain more favorable payoff terms, such as a lower interest rate, lower monthly payments, or both.

There are also no surprises – with fixed loan terms and payments, you’ll know exactly what to expect every month.

Debt consolidation can happen on debts which are not tied up to an asset, which may include credit card bills, medical bills, other unsecured personal loans, student loans, education loan, payday loan, etc.

Debt consolidation is a debt management strategy.

Consolidation does not automatically erase your debt, but it does provide some borrowers with the tools they need to pay back what they owe more effectively.

The goal of consolidation is twofold. First, consolidation condenses multiple monthly payments, often owed to different lenders, into a single payment. Second, it can make repayment less expensive. By combining multiple balances into a new loan with a lower interest rate, you can reduce cumulative interest, which is the sum of all interest payments made over the life of a loan.

WHY PROTON LOAN'S DEBT CONSOLIDATION LOAN?

• PROTON LOAN'S DEBT CONSOLIDATION LOAN offers unique features like unemployment protection which can be a lifesaver for a borrower who loses their job. Once a job loss has been reported, the lender will put payments on pause for up to three months at a time.

• Because there are no origination fees, PROTON LOAN'S DEBT CONSOLIDATION LOAN cost less than most loans.

• One thing that sets PROTON LOAN'S DEBT CONSOLIDATION LOAN apart is that it allows an applicant to bring a co-applicant who may have a higher credit score.

• PROTON LOAN'S DEBT CONSOLIDATION LOAN is one of the rare lenders that may be able to provide same-day funding.

• Debt consolidation isn't one-size-fits-all. That's why PROTON LOAN'S DEBT CONSOLIDATION LOAN offers solutions to help you consolidate your debt in a way that works for you.

• PROTON LOAN'S DEBT CONSOLIDATION LOAN gives you a choice to have the money sent to your bank account or directly to your creditors as soon as the next business day after you are approved for and accept the terms of your loan.

• PROTON LOAN'S DEBT CONSOLIDATION LOAN provide great opportunity of 'True Debt Termination', See, as soon as you’ve paid off all of your miscellaneous debts – credit cards, medical bills, personal loans, car payments, etc. – your credit history is going to show dramatic improvement, especially after you’ve made the first few payments on your consolidation loan

• No collateral required.

• No application fees.

• No pre-payment penalties.

• Free Credit Life Protection of up to $55,000 in the event of a loss.

BENEFITS OF PROTON LOAN'S DEBT CONSOLIDATION LOAN:

• Lower interest rate: Most debt consolidation loans have a lower interest rate than credit cards. The best credit card consolidation loans will help you in paying off high-interest debt with a low-interest loan to save you thousands of dollars over the life of a loan.

• Lower monthly payments: If you have a lower interest rate, you'll likely also have lower monthly payments. If you find yourself worrying about how you're going to repay credit debt or other unsecured debt, a debt consolidation loan can help you lower the total monthly payment due.

• Clear finish line: From the time a lender approves your consolidation loan, you will know precisely the repayment term and when it's due to be paid off.

• Fewer bills: Consolidating multiple debt loans into a single personal loan means you will have fewer bills to juggle. If you're busy like most people, having one installment loan to pay can simplify your life. Rather than making sure each credit card payment is sent, writing a check for your auto loan, and double checking that all other bills are covered, you pay a single monthly payment.

• Higher credit score: You may be able to improve your credit score by making regular payments. Since your credit history plays a role in everything from renting an apartment to whether you qualify for the lowest auto insurance rates, raising your credit score makes life easier. Once you've achieved excellent credit, you will have access to the best interest rates and loan terms next time you need to borrow money.

Consolidation loans aren’t magic. They don’t make your debt go away; they make it more manageable. You have to do the rest by managing itThe good news is that you’re absolutely capable of doing this; we’re sure of it. And you don’t have to do it alone. We’ll be here the whole time to talk you through it along the way.

**NOTE**

Debt consolidation won’t erase what you owe, but ideally you set yourself up with better terms, such as a lower interest rate to save money. A note on avoiding future debt

It takes a lot of work and commitment to pay down your debt, so once you've done so, you'll want to avoid a repeat. Here are some proven techniques to keep your finances on track:

Develop a budget and stick with it.

Build an emergency fund to help you cover unexpected expenses.

Consider putting off big expenditures such as a new car or a big vacation until you've got money saved in advance.

Your goal must be stop adding to your debt, and also to pay down the debt you already have, if you can. It is called budgeting and money management.

Let's face it—spending money can be a lot of fun. But when you have a mountain of debt in your way, the fun times can fade quickly

THERE WILL BE NO WALL BETWEEN

YOU AND US

AS PROTON LOANS IS A DIRECT LENDER

**** HENCE NO GLITCHES ****

Your application is rapidly handled and assisted with money sent directly into your account within 24 hours or the SAME DAY for FREE on loans approved

HERE’S HOW IT WORKS

Getting a loan through Proton Loans is a simple

.. 3 - step process ..

APPLY ONLINE:

exploring your rate options won’t affect your credit score and if you qualify our simple application takes just a few minutes.

GET A FAST DECISION:

You like to move fast. We do, too.That’s why we offer decisions within minutes whenever possible.

RECEIVE YOUR FUNDS:

If approved, we’ll deposit money directly into your account within 24 hours or the SAME DAY for FREE.

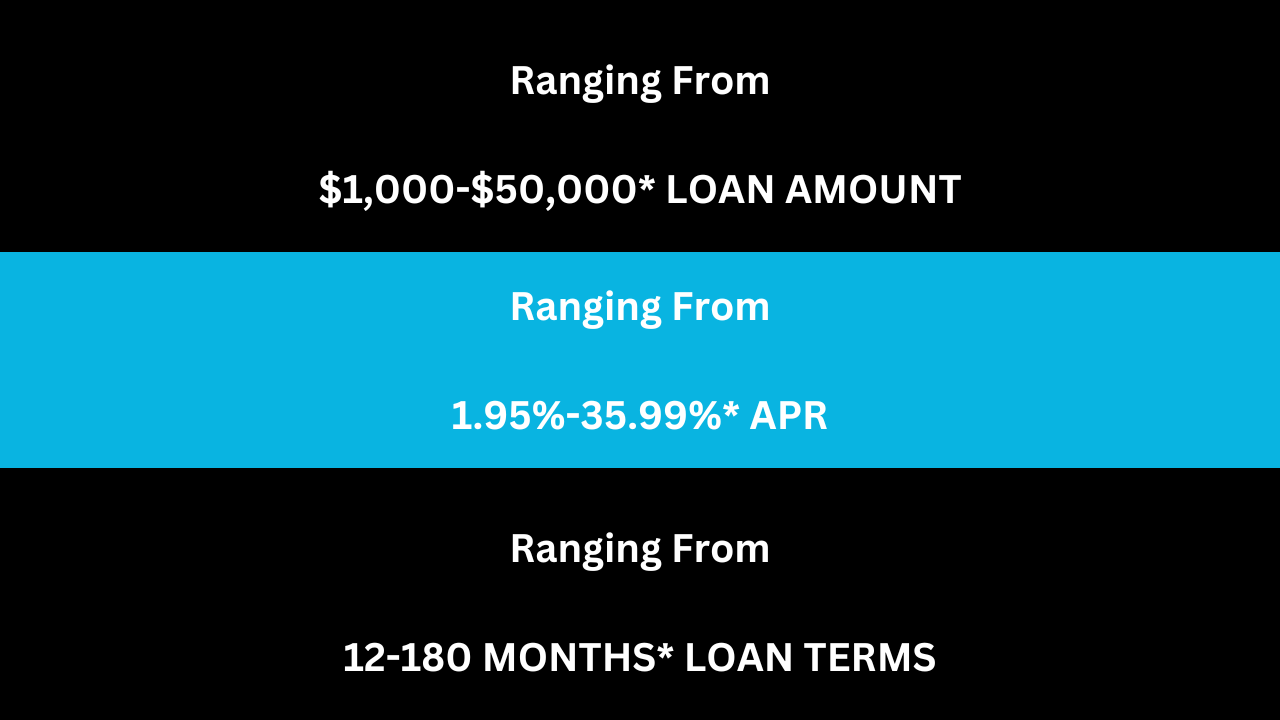

WE OFFER A RANGE OF LOAN OPTIONS

You have choices. We’ll make sure you understand them.